Loan Repayment Process

Repaying your student loans is an important step as you transition beyond your time at the university. Understanding how repayment works, who your loan servicer is, when repayment begins, what repayment plans are available, and how to manage your loans responsibly can help you stay on track and avoid unnecessary costs.

Who is your Loan Servicer

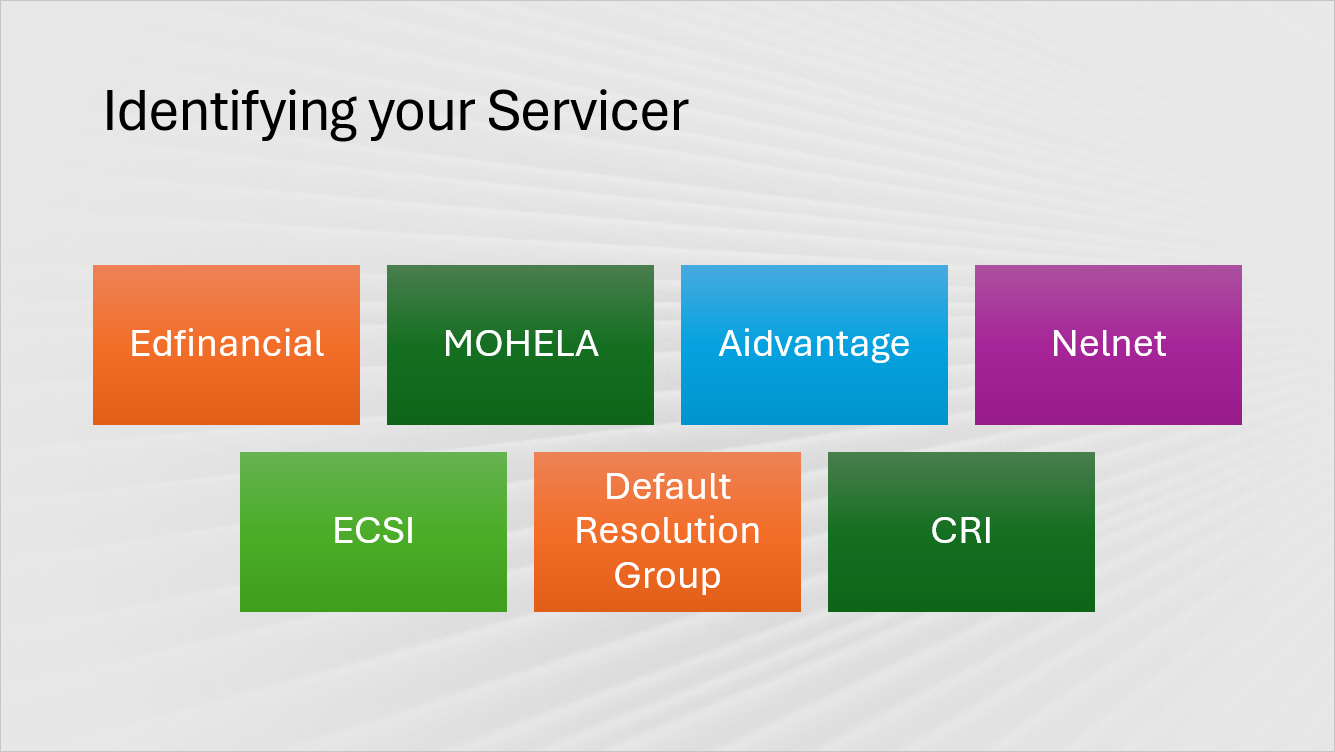

A loan servicer is a company that the federal government assigns to handle the billing and other services on your federal student loan on our behalf. Your loan servicer will work with you on repayment options (such as income-driven repayment plans and loan consolidation) and will assist you with other tasks related to your federal student loans.

Keep your contact information up to date so your loan servicer can help you stay on track with repaying your loans. If your circumstances change at any time during your repayment period, your loan servicer will be able to help.

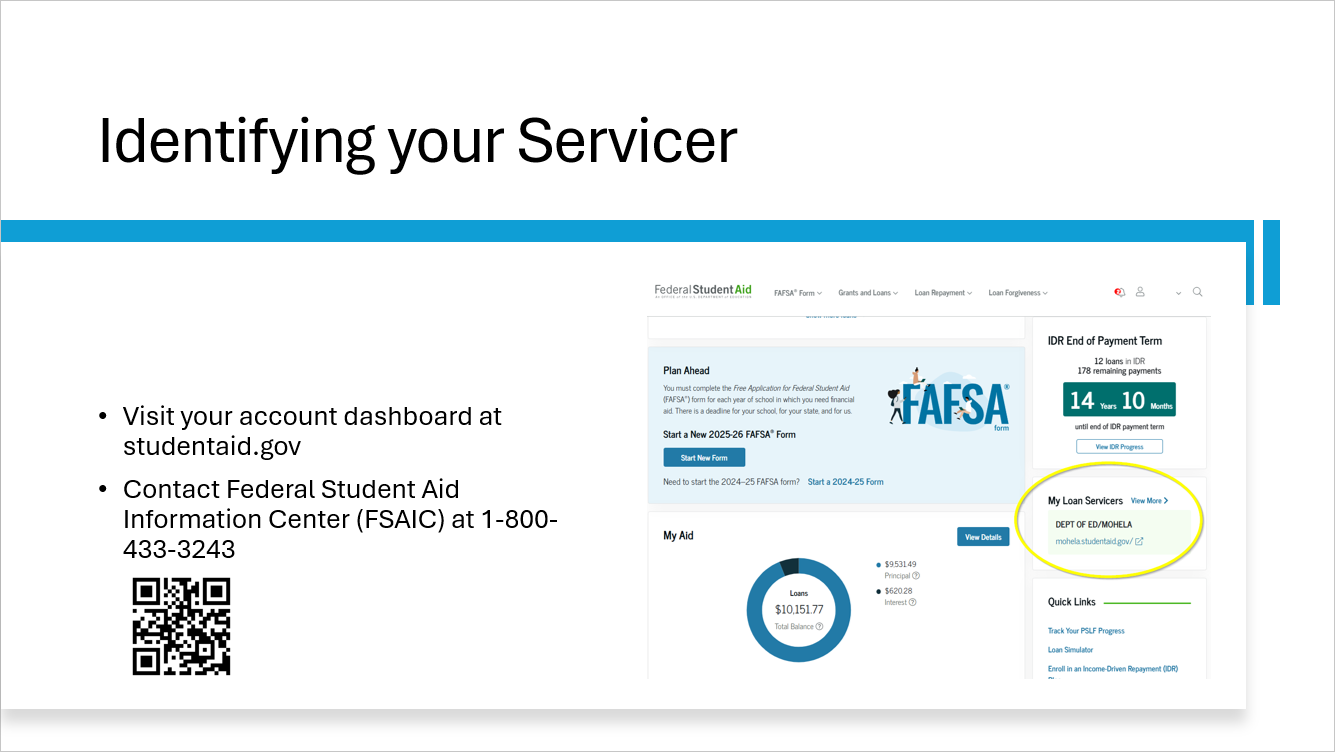

You can identify your federal loan servicer by logging in to your Federal Student Aid account at StudentAid.gov.

Your servicer is your main point of contact for payment schedules, applying for income-driven

repayment plans, updating contact information, and requesting deferment or forbearance.

Keeping your contact information up to date ensures you never miss important notifications.

Identifying your Loan Servicer

(See the highlighted section in the screenshot.)